Closing the infrastructure gap

The Addis Ababa Action Agenda delineates impediments to investment in infrastructure on both the supply and demand side. It emphasizes that in many countries, insufficient investment is due in part to inadequate infrastructure plans and an insufficient number of well-prepared investable projects, which underscores the need for government policies along with capacity development. At the same time, financing is insufficient. Public funds are limited, while the existing incentive structures of many private investors are not necessarily aligned with the long-term investment horizon necessary for many infrastructure projects. The Agenda points out, though, that given the large financing gap in infrastructure, all financing sources — public, private, domestic and international — will be needed.

Specifically, the Addis Agenda includes the following subpoints:

Bridging the global infrastructure gap, including the US $1-1. 5 trillion gap in developing countries

- Identify and address infrastructure and capacity gaps across countries and sectors, in particular in LDCs, LLDCs, SIDS and African countries

As a key pillar to meet the sustainable development goals, establish a global infrastructure forum, led by the multilateral development banks, aiming to:

- Improve alignment and coordination among infrastructure initiatives

- Encourage a greater range of voices to be heard, particularly from developing countries

- Work to ensure investments are environmentally, socially and economically sustainable

Domestic actions and international cooperation for infrastructure financing

- Governments commit to embed resilient and quality infrastructure investment plans in national sustainable development strategies, and to improve domestic enabling environments

- Commit enhanced financial and technical support to facilitate development of sustainable, accessible and resilient quality infrastructure in developing countries, including to translate plans into concrete project pipelines, as well as for individual implementable projects, including for feasibility studies, negotiation of complex contracts, and project management

Development banks and infrastructure financing

- Calls on national and regional development banks to expand contributions in sustainable infrastructure

- Emphasizes the role of MDBs in infrastructure investment, including sub-sovereign loans, and encourages MDBs to address regional infrastructure gaps

- Encourages MDBs to help channel resources of long-term investors towards sustainable development, including through long-term infrastructure and green bonds

Private investment in infrastructure

- Encourages long-term institutional investors, such as pension funds and sovereign wealth funds, which manage large pools of capital, to allocate a greater percentage to infrastructure, particularly in developing countries

Public and private blended finance for infrastructure financing

- Calls for projects involving blended finance, including PPPs, to share risks and rewards fairly, include clear accountability mechanisms and meet social and environmental standards

- Calls for careful consideration on the structure and use of blended finance instruments

- Commits to capacity development for PPPs and to build a knowledge base and share lessons learned through regional and global forums

- Commits to hold inclusive, open and transparent discussion when developing and adopting guidelines and documentation for the use of PPPs

Latest developments

Given the enormous infrastructure investment needs, public, private, domestic and international resources will be required. However, public and private sources of finance are not substitutable. Each has its own incentive structures, goals and mandates. Meeting infrastructure investment needs will require credible financing plans, which can be incorporated into integrated national financing frameworks (INFFs). Raising public revenues and reallocating existing spending to infrastructure should be key elements of such plans but may not be sufficient. For countries with moderate debt levels, additional borrowing might be possible, especially for projects that generate financial returns. Galvanizing private sector involvement is possible, but the associated fiscal costs and risks need to be carefully managed

Given financing constraints, countries will also need to deliver more infrastructure “bang” for their public investment “buck”. More than a third of public investment spending is lost through inefficiency, with larger efficiency gaps in LDCs and other developing countries. Stronger infrastructure governance can lead to higher output and efficiency of public investment while also deterring corrupt behaviour, which poses great risks, particularly for large projects. Improving infrastructure governance could close more than half of the observed efficiency gap. Better

Private investment in infrastructure projects in developing countries has been low relative to historical averages, at less than $100 billion a year between 2016 and 2018. While infrastructure commitments increased 14 per cent in the first half of 2019, the yearly figure will remain well below the $160 billion peak reached in 2012.2 In particular, since 2014, investment has fallen in sectors with more limited financial returns, such as water, sanitation and hygiene, and education. Investment in the generation, transmission and distribution of electricity has remained flat, while investment in telecommunications, transport and agriculture has increased.

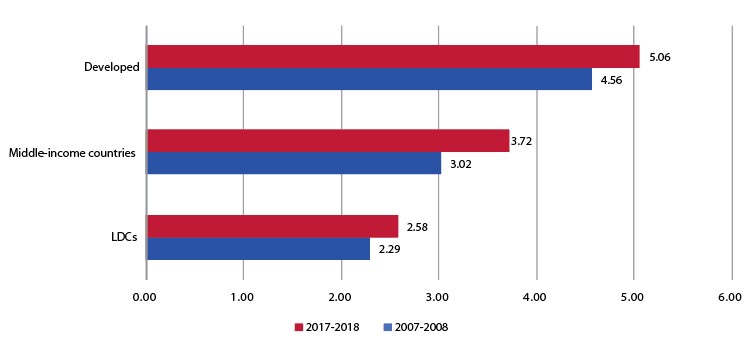

The perceived infrastructure quality gap between developed and least developed countries (LDCs) has grown, not shrunk, over time according to surveys of business executives in more than 130 countries.

Perceptions of infrastructure quality

(Score 1-7 (best))

Source: UN DESA, based on The World Economic Forum Global Competitiveness Reports (World Economic Forum, 2019).

Well-developed infrastructure plans are needed to address these gaps. They should include adequate stakeholder consultations and incorporate climate impact, disaster risk assessments and resilience, as well as gender assessments in order to provide a long-term vision. This vision will allow countries to avoid having costly stranded assets later on, such as coal-fired power plants, or essential infrastructure assets unable to function during and after natural disasters. Each dollar invested in infrastructure resilience is expected to deliver a $4 benefit through avoided repairs and disruptions and lower maintenance costs in low- and middle-income countries.

Technological advancements can help project prioritization and planning, for instance, through data analytics and enhanced project management. Technological change is also influencing the choice of infrastructure by impacting costs.

Read more on providing infrastructure services while leveraging technology.

See also

- 2020 FSDR Thematic chapter: becoming digital ready – digital infrastructure, complementary infrastructure

- 2019 FSDR Private chapter: private investment in infrastructure, financial infrastructure

- 2019 FSDR Systemic chapter: impact of regulatory reform on infrastructure finance

- 2018 FSDR Thematic chapter: financing investment in selected SDGs

- 2017 FSDR Thematic chapter: long-term quality investment for infrastructure

Welcome to the United Nations

Welcome to the United Nations