The Addis Ababa Action Agenda recognizes the need for action in attaining long-term debt sustainability. Strengthening the monitoring and prudent management of assets and liabilities is an important element of comprehensive national financing strategies and is critical to reducing vulnerabilities. The Addis Agenda emphasizes that debtors and creditors have to work together to prevent unsustainable debt situations. While it notes that maintaining sustainable debt levels is the responsibility of the borrowing countries, it also acknowledges that lenders have a responsibility to lend in a way that does not undermine a country’s debt sustainability.

The Addis Agenda specifically:

- Commit to support the maintenance of debt sustainability in those countries that have received debt relief and achieved sustainable debt levels

- Invite the IMF and World Bank to strengthen the analytical tools for assessing debt sustainability in an open and inclusive process with the United Nations and other stakeholders

Latest developments

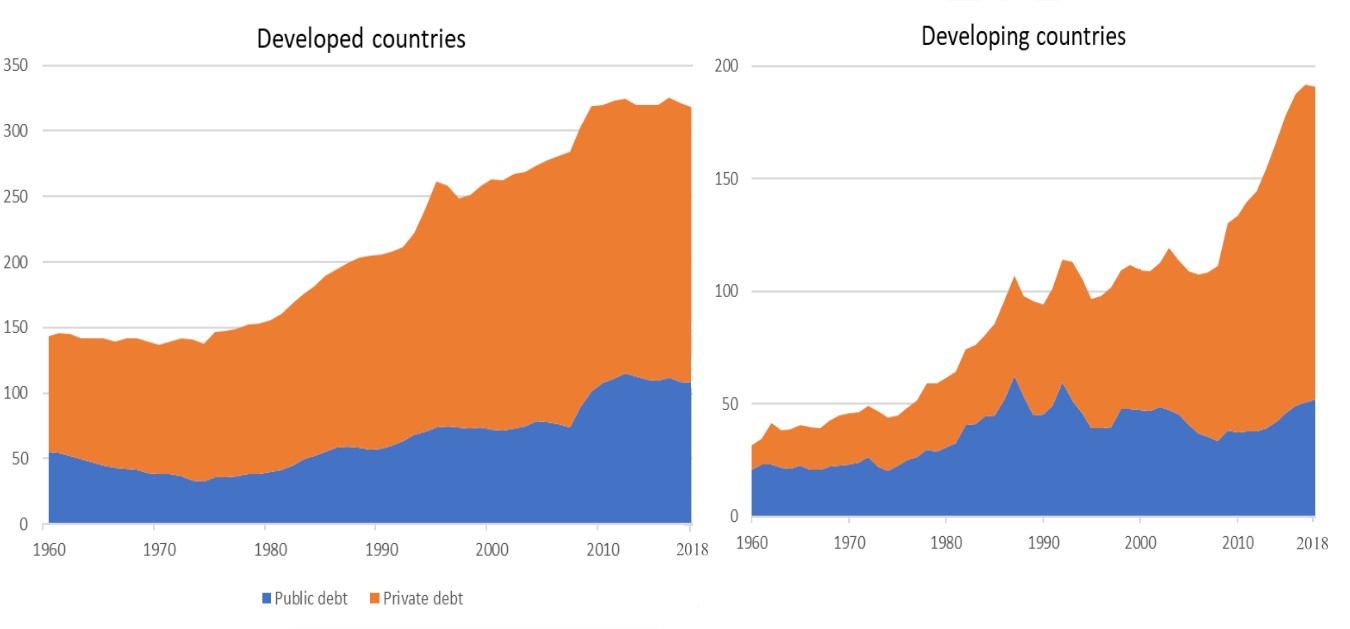

Global debt continues to rise. Total global debt stocks grew over 5 per cent in 2018 to reach $228 trillion (or 267 per cent of global GDP), compared to $152 trillion (239 per cent of global GDP) at the onset of the global financial crisis in 2008. The growth in global indebtedness has been driven by an explosion of private sector debt since the 1980s. In developed countries, the growth rate for debt decelerated after the initial increase in public debt in the wake of the global financial crisis. In developing countries, however, both public and private debt increased, with private debt accelerating particularly sharply following the crisis.

Total debt, developed and developing countries, 1960–2018

(Percentage of GDP)

Source: UNCTAD Secretariat calculations, based on the IMF Global Debt Database.

Overall, and prior to the COVID-19 outbreak, International Monetary Fund (IMF) projections pointed to stabilizing debt-to-GDP ratios for low-income developing countries going forward, after several years of upward revisions. Nonetheless, debt sustainability assessment stress tests suggested that many countries remain exposed to a downgrade in the event of global shocks. About 44 per cent of low-income developing countries eligible for the IMF Poverty Reduction and Growth Trust (PRGT) were assessed at high risk of external debt distress or already in debt distress before COVID-19 (figure III.E.2); Nineteen of them are LDCs. Ten countries, including six LDCs, were assessed to be in debt distress as of end-2019 (Eritrea, the Gambia, Grenada, Mozambique, the Republic of the Congo, Sao Tome and Principe, Somalia, South Sudan, Sudan and Zimbabwe).

Read the latest analysis by the Task Force here.

Predicting the impact of borrowing for investment on growth rates (e.g., in the context of debt sustainability assessments (DSAs)) is extremely challenging, due to uncertainties around investment efficiencies and growth feedback. To address the potential feedback, the IMF and World Bank included a “realism tool” in their July 2018 update to the low-income countries’ debt sustainability framework (LIC-DSF). The realism tool uses a simple growth accounting framework and decomposes projected growth rates into contributions from changes in the government capital stock (due to public investment) and all other sources. It shows projections for public and private investment, and historical and projected contributions of public investment to growth. The LIC DSF also newly incorporates other key elements, including additional stress tests tailored to country-specific economic vulnerabilities, increased requirements for debt transparency, and broader debt coverage.

Read more on debt sustainability assessments (improving analytical tools) here.